26+ mortgage debt ratio limit

Web Ultimately your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. In general 43 is the maximum debt-to-income ratio that mortgage lenders accept.

Debt To Limit Ratio Calculator

Find A Lender That Offers Great Service.

. Looking For Conventional Home Loan. Web rules amending the Ability-to-RepayQualified Mortgage Rule ATRQM Rule. Web For example if you have a monthly income of 5000 and your total monthly debt is 1500 you have a debt-to-income ratio of 30.

Find A Lender That Offers Great Service. FHA mortgage insurance All. Comparisons Trusted by 55000000.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad 5 Best Home Loan Lenders Compared Reviewed. 2100mo 2100mo Next step.

Web The rule is simple. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. However an ideal front-end ratio or amount you spend on your mortgage is 28 and 36 is ideal for a back-end ratio what you spend on the rest of your bills.

Having a DTI ratio of 36 or less is considered ideal. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Debt-to-income ratio 36 Your DTI is good.

Ad Learn More About Mortgage Preapproval. Browse Information at NerdWallet. Web fees limits and underwriting requirements.

Browse Information at NerdWallet. Web Experts say you want to aim for a DTI of about 43 or less. These final rules are.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Total household debt doesnt exceed more than. Web Most lenders want your debt-to-income ratio to be no more than 36 percent but some lenders or loan products may require a lower percentage to qualify.

General QM Final Rule. Ad Calculate Your Payment with 0 Down. Maximum household expenses wont exceed 28 percent of your gross monthly income.

Web For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. Under the original ATRQM Rule the ratio of the consumers total monthly debt to total monthly income DTI or DTI ratio could not. Comparisons Trusted by 55000000.

Compare Lenders And Find Out Which One Suits You Best. Ad 5 Best Home Loan Lenders Compared Reviewed. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

223952 a 6 percent increase year-over-year. Lets say your pre-tax income is 4000. When considering a mortgage make sure your.

Ad Learn More About Mortgage Preapproval. Compare More Than Just Rates. You might be able to pay down your credit cards or reduce other monthly debts.

Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. Web In most cases lenders set a limit of 40 for your TDS ratio. The lower your debt-to-income ratio.

Lowering your debt-to-income ratio If you find your DTI is too high consider how you can lower it. Compare Lenders And Find Out Which One Suits You Best. Web Total amount of mortgage debt originated in Q2 2022.

In reality however depending on your. Lenders prefer to see a debt-to. Looking For Conventional Home Loan.

ZIP Code Get pre-qualified Explore more mortgage calculators. Why is the DTI ratio so important. 758 billion Federal Reserve Bank of New York Average mortgage debt at the end of 2021.

For loan casefiles underwritten through DU the maximum allowable DTI ratio is. That said its possible to exceed the TDS and GDS ratio limits if youre purchasing a home as a couple. Financial professionals often recommend keeping your debt-to-income ratio under 36 when you are applying for a.

That said a lower debt-to-income ratio is always better. Web What is the maximum debt-to-income ratio for mortgages. Web What is a good debt-to-income ratio for mortgages.

The maximum can be exceeded up to 45 if the borrower meets the credit score and reserve requirements reflected in the Eligibility Matrix. Find out if you qualify to buy Youve estimated your DTI now get pre-qualified by a local lender to find out just how much you can borrow. Web As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage.

Web Your maximum for all debt payments at 36 percent should come to no more than 2160 per month 6000 x 036 2160. Compare More Than Just Rates. Getty Images A good debt-to-income ratio is key to loan approval whether youre seeking a mortgage.

The General QM Final Rule replaces the existing 43.

List Of Top Personal Loan Providers In Sharda Vachanalaya Best Personal Loans Online Justdial

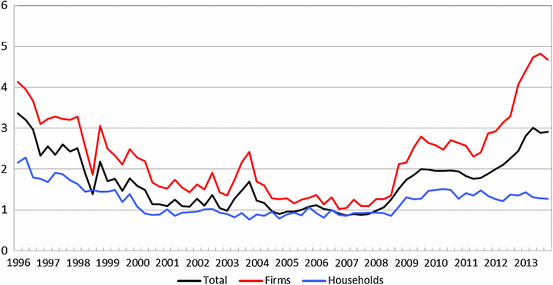

The Household Debt Ratio Is An Unsuitable Risk Measure There Are Much Better Ones Lars E O Svensson

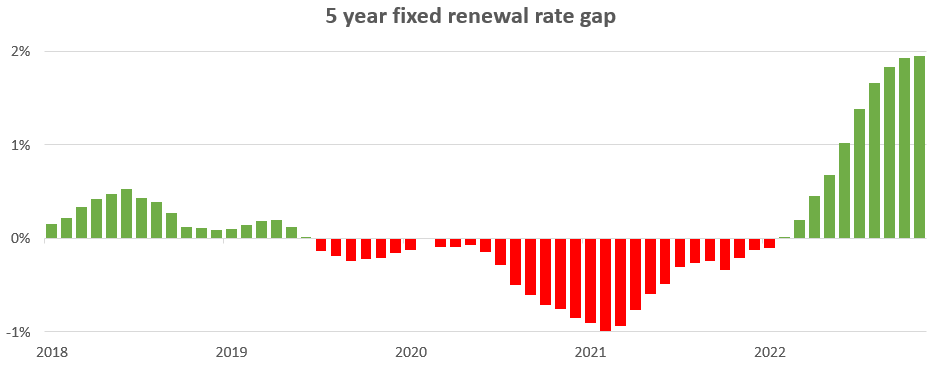

Changing Rates And The Market House Hunt Victoria

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio For Mortgages How Dti Affects Home Loans Debtwave

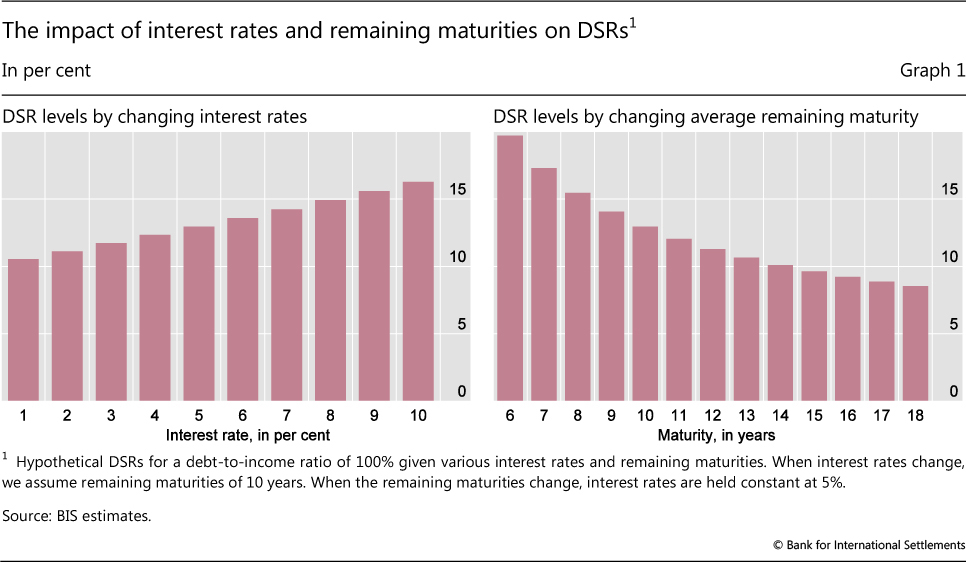

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What Are Business Expenses Examples Working Taxation Trackers

Fannie Mae Debt To Income Ratio Limit Increase Credit Karma

Wall Street Journal Sounds Fake Alarm Over Mortgage Debt Mother Jones

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Debt To Income Ratio Loan Pronto

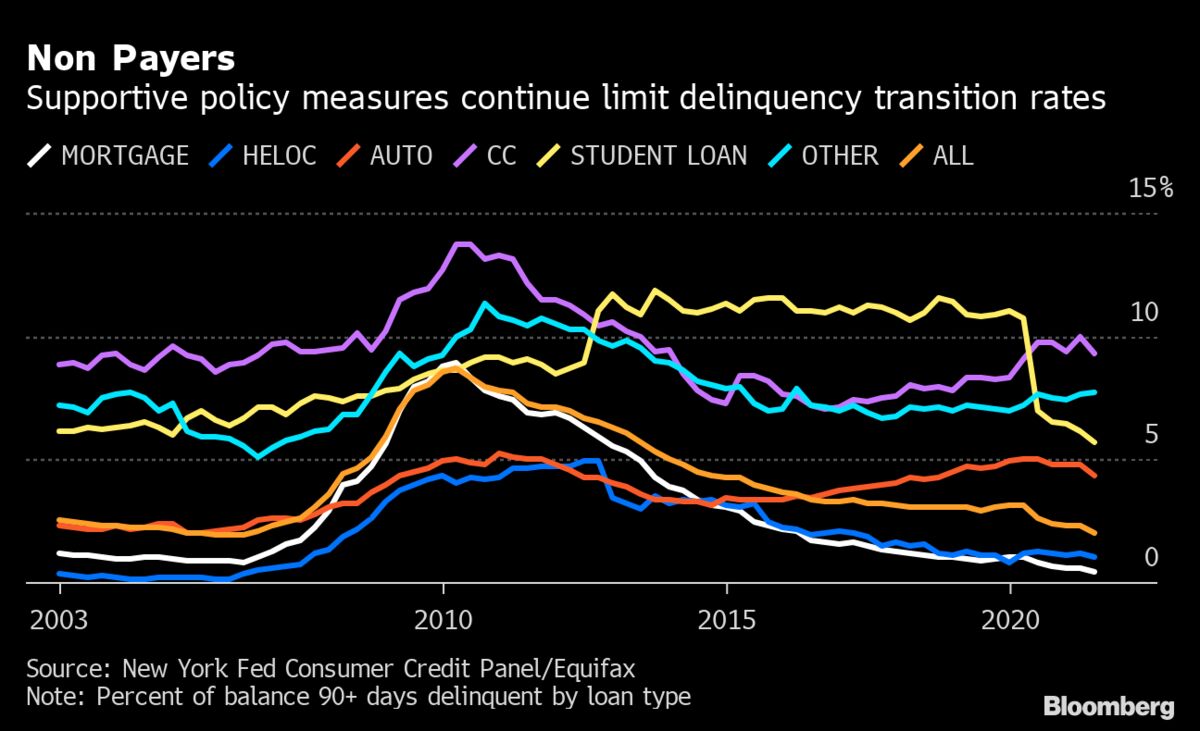

Us Mortgage American Household Debt Jumps Most Since 2013 On Boom Bloomberg

Debt To Income Ratio To Be Able To Qualify For A Mortgage

![]()

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

The Role Of Leverage In Firm Solvency Evidence From Bank Loans Springerlink

Examining Rental Housing In The Us Debt Financing Characteristics Eye On Housing